The 2023 federal budget announced significant changes to the Alternative Minimum Tax (AMT) system. The federal AMT is a parallel tax calculation for individuals that allows fewer deductions, exemptions, and tax credits to be deducted compared to the ordinary income tax rules. It was introduced to ensure that individuals who benefited from preferential tax treatment for income or tax deductions, would always pay a minimum amount of tax. Although there have been minor adjustments, the current AMT rules are not substantially different from when they were first introduced in 1986.

This article will review the changes and the impact they will have on many high-income individuals. In particular, individuals who realize large capital gains, or who have significant tax deductions or charitable donations could be impacted. And while we will focus on the AMT and its impact on individuals, it can also apply to trusts.

How does the AMT work?

For most individuals, AMT is not a concern as their personal tax will be higher than the tax calculated under AMT. But it can impact taxpayers who benefit from preferential tax treatment on certain items such as how capital gains are taxed, or who claim large tax deductions or credits.

If you use tax software to prepare your personal return, it will calculate both regular income tax and AMT. For any year, an individual pays AMT or regular federal income tax, whichever is higher. Where the AMT is more than regular income tax otherwise calculated, the additional tax paid can be carried forward for seven years to offset regular tax to the extent regular tax exceeds AMT in the carry forward period. This means that AMT is essentially a prepayment of tax if the individual can recover AMT paid within the 7-year period.

The proposed changes are meant to address the government’s concerns that too many high-income individuals pay little or no income tax in a given year as a result of certain tax incentives. For certain individuals, AMT under the proposed changes will increase substantially. For example, AMT may apply to an owner-manager who claims the lifetime capital gains exemption on the gain realized on the disposition of their qualifying small business corporation shares. But the changes also include a substantial increase to the AMT exemption amount which will mean that fewer individuals will be subject to AMT.

What are the changes?

There are three main components to the proposed changes to AMT, including broadening the AMT base, raising the AMT exemption amount, and increasing the AMT rate, explained in further details below:

1. Broadening the AMT base:

The budget proposes several changes to broaden the AMT base by further limiting tax preference items. This includes adding items that are not currently included in the calculation of the AMT base and increasing the inclusion rates of other items:

- Increasing the capital gains inclusion rate from 80% to 100% for AMT purposes, while decreasing the inclusion rate for capital loss carryforwards and allowable business investment losses from 80% to 50%.

- Including 100% of the benefit associated with employee stock options, which under regular rules are taxed at 50%.

- Adding 30% of capital gains on donations of publicly-listed securities, which under regular rules will not be subject to any tax.

- Disallowing 50% of various deductions, such as interest and carrying charges incurred to earn property income, deduction for limited partnership losses of other years, non-capital loss carryovers, employment expenses (other than those to earn commission income), moving expenses, and childcare expenses.

- Allowing only 50% of non-refundable tax credits to reduce the AMT (with certain limited exceptions).

2. Raising the AMT exemption:

The current AMT basic exemption is $40,000 available to all individuals. The budget proposes to increase this exemption to the start of the fourth federal tax bracket, which is $165,430 for 2023 and estimated to be $173,000 for 2024. This exemption amount will be indexed to inflation each year.

3. Increasing the AMT rate:

Lastly, the proposals include an increase in the AMT rate from 15% to 20.5%.

When are the changes effective?

Draft legislation has not yet been released, but the budget documents indicated that the proposed changes would take effect beginning in 2024.

Example:

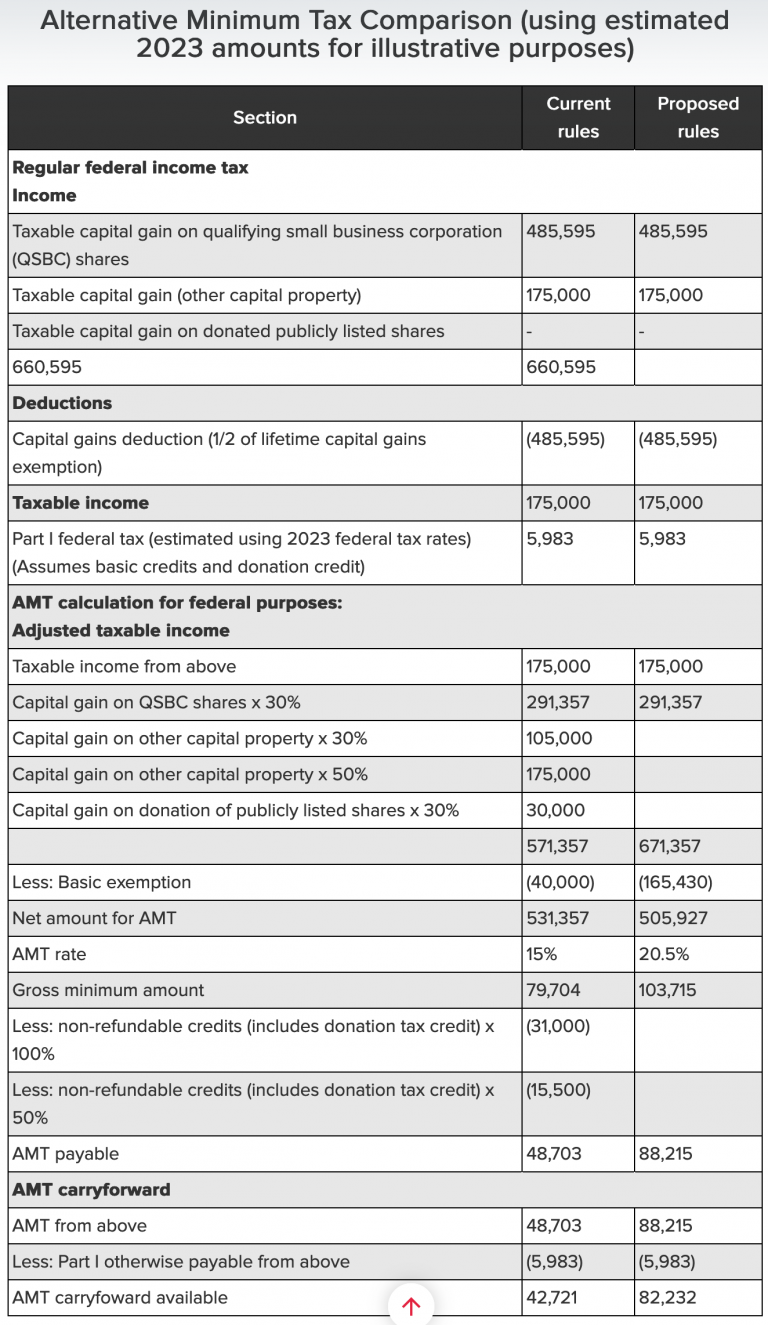

In the following illustration, the taxpayer performed an estate freeze and crystallized the lifetime capital gains exemption (LCGE) of $971,190 on her qualifying small business corporation (QSBC) shares. In the same year, she also earned capital gains on her other investments of $350,000 and donated publicly listed securities with a capital gain of $100,000.

Under the ordinary tax rules, crystallizing her LCGE results in no immediate tax (i.e., 50% of the capital gain is sheltered by 50% of LCGE of $485,595). The taxable portion of the capital gains realized on her other investments increases taxable income by $175,000. The capital gain on the donation of publicly listed shares is exempt from capital gains tax and also provides a donation tax credit.

In this scenario, the taxpayer has $5,983 of federal income tax payable under the ordinary tax rules. However, AMT is in excess of this amount and brings her federal income taxes up to $48,703. The difference between AMT and regular income taxes results in a $42,721 AMT carry forward.

As illustrated, under the proposed AMT rules, the taxpayer’s federal income tax liability increases to $88,215. This is a result of the increase in the capital gain inclusion rate for AMT purposes from 30% to 50% on her other investments, and from nil to 30% on the gain from the donation of publicly listed securities.

In addition, while the basic exemption increased from $40,000 to $165,430, the AMT rate also increased from 15% to 20.5%. Furthermore, only 50% of her non-refundable tax credits, including her donation tax credit, will be available to reduce her AMT. Due to these changes, the taxpayer’s AMT under the proposed rules is $88,215, which is much higher than under the current rules, and she has an AMT carry forward of $82,232.

Note that any applicable provincial AMT would increase the individual’s total income tax payable for the year.

Additional thoughts

Depending on the facts, the federal AMT payable under the proposed rules may be significantly higher than under the current rules, even though the basic exemption will be increased.

Owner-managers considering tax planning to create a large capital gain after 2023 should carefully consider the implications of the proposals with their tax advisor. Similarly, taxpayers considering making large donations to registered charities should assess the impact this will have on AMT under both the current and the proposed rules. As AMT also applies to most types of trusts, it is important for trustees and their advisors to think about the implications of the proposed measures as well.

Individuals impacted by the changes will want to plan to effectively manage the AMT to ensure that they will be able to recover AMT paid in the carry forward period, where possible. Planning to minimize the impact of AMT will be especially important for individuals in retirement who expect low taxable income in the future. The proposals, if passed into law, would come into effect beginning in 2024.To understand how the rules may impact you or any tax planning being contemplated, contact a BMG Financial tax advisor

To understand how the rules may impact you or any tax planning being contemplated, contact a BMG Financial tax advisor